Don’t Believe the Scare Tactics: Cash Still a Leading Form of Payment in U.S.

September 10, 2015

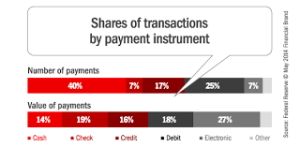

Even with potentially transformational technologies such as Apple Pay stealing a lot of headlines, rumors of cash’s demise are greatly exaggerated.

Two recent studies underscore Americans’ continued desire to carry paper money, and the need for financial institutions to maintain and perhaps even grow accessible, user-friendly and secure ATM networks.

Despite early niche success within open-loop systems such as Apple Pay and closed-loop systems like the one employed by Starbucks, consumers make only a tiny fraction of in-store purchases with mobile devices, according to a research paper by the ATM Industry Association (ATMIA) and Tremont Capital Group.

“Over the next five years, to the extent that mobile payments do take share from other forms of payment, it will be from electronic payments” such as debit, credit, gift cards and prepaid cards, the report indicates. “Any share shift from cash to mobile between 2015 and 2020 will be negligible.”

“Over the next five years, to the extent that mobile payments do take share from other forms of payment, it will be from electronic payments” such as debit, credit, gift cards and prepaid cards, the report indicates. “Any share shift from cash to mobile between 2015 and 2020 will be negligible.”

The research paper “U.S. Mobile Payments: Do They Disrupt Cash?” backs ATMIA’s global findings of 8.9 percent average year-over-year growth of cash in circulation, compared to economic growth rates below 3 percent.

“In truth, cash use is more robust and mobile payments less stellar in growth than current conventional wisdom might suggest,” concludes ATMIA CEO Mike Lee.

Meanwhile, Americans use ATMs nearly 6 billion times each year, according to a recent U.S. Federal Reserve study. Consumers make approximately 30 percent of those transactions at out-of-network ATMs, a personetics.com report indicates, at an average charge of $2.77, statistics website Statista calculates.

These aren’t “gotcha” charges; consumers typically confirm their understanding of the fees when executing the payment. So, clearly, we as a society have decided the ability to access cash anywhere, anytime, is worth the trade-off of paying the vendor to handle it.

Why do people still prefer cash, even as a greater share of consumers access plastic cards and merchants have relaxed or abandoned their restrictions on small transactions using those cards? A Federal Reserve report from the Diary of Consumer Payment Choice (DCPC) offers six reasons, based on a large-scale consumer survey:

- Cash plays a dominant role for small-value transactions. The average value of a cash transaction is $21.

- Cash is the leading payment instrument for specific types of purchases, including personal gifts, entertainment options, and transportation charges.

- Cash is the key alternative when other options are not available. Cash isn’t consumers’ first choice overall, but is the backup across the board for every other preferred form of payment — including debit card users.

- Cash is the leading payment alternative for Gen Y. The youngest subset of millennials (ages 18 to 24) prefer using cash at a higher rate (40%) than any other age group.

- Cash is a primary payment option for lower income segments, particular people with household incomes under $25,000.

- Cash can’t be hacked.

The message for financial institutions is clear: Even as you invest in these new payment strategies, you’re missing the boat if you don’t maintain a clean, functional and secure ATM fleet. Because for a large number of Americans, cash remains a viable currency, and the most universal.

J&P Site Experts provides ATM installation/rigging services as well as ATM cleaning & inspection, and ATM maintenance & repairs. To get in touch, visit our Contact Us page.

©2024 J&P ATM Site Experts, LLC

©2024 J&P ATM Site Experts, LLC